Liquidity Trap: Definition, Causes, and Examples

Por um escritor misterioso

Last updated 06 junho 2024

:max_bytes(150000):strip_icc()/liquiditytrap.asp_Final-6590b33aa8b54861871f159ddcbf8aac.png)

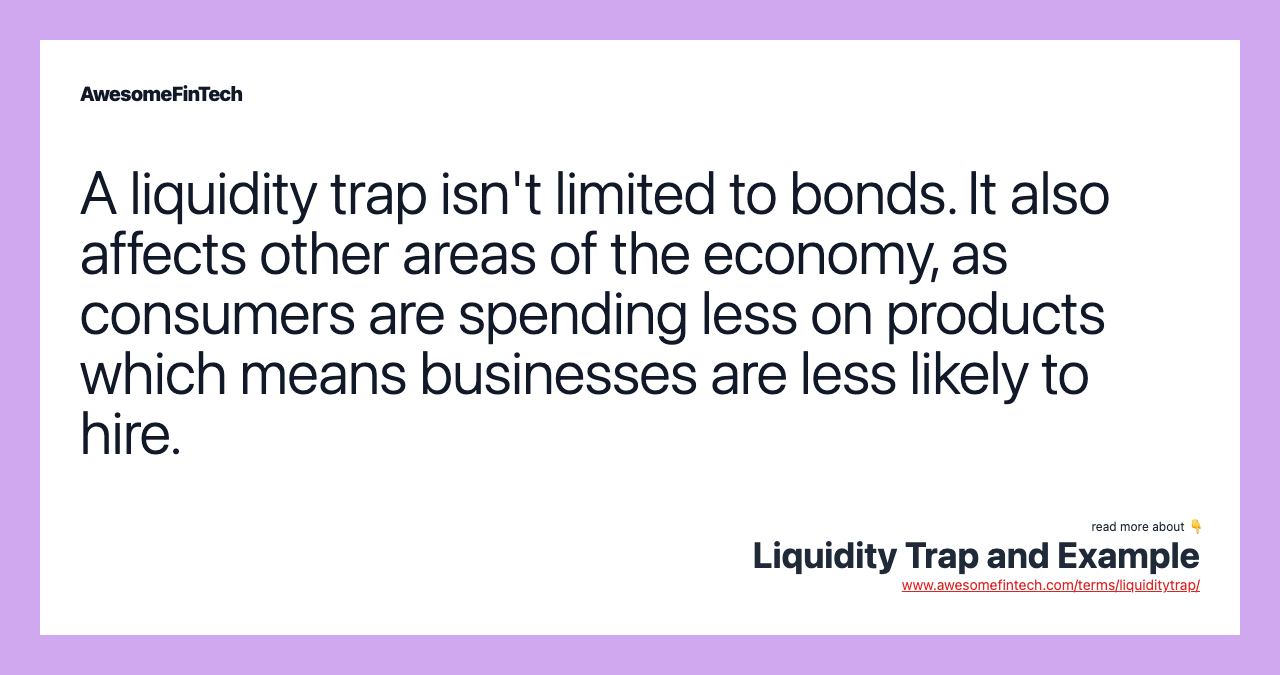

A liquidity trap can occur when consumers and investors hoard cash and refuse to spend even when economic policymakers cut interest rates to stimulate economic growth.

:max_bytes(150000):strip_icc()/GettyImages-656522782-fd5d8ecb58bb41a39912cf69c545a0e5.jpg)

Liquidity Trap: Definition, Causes, and Examples

What is Liquidity Preference Theory? Definition, Diagram and Liquidity Trap- The Investors book

:max_bytes(150000):strip_icc()/GettyImages-1227117113-c0c9561f5d7248d1af7e45fa01dce911.jpg)

Liquidity Trap: Definition, Causes, Cures

Detection and Solution of Liquidity Traps

Comments: Foreign Exchange Origins of Japan's Liquidity Trap in: Reforming the International Monetary and Financial System

Liquidity Trap and Example

:max_bytes(150000):strip_icc()/93751256-5bfc388bc9e77c0051835beb.jpg)

Liquidity Trap: Definition, Causes, and Examples

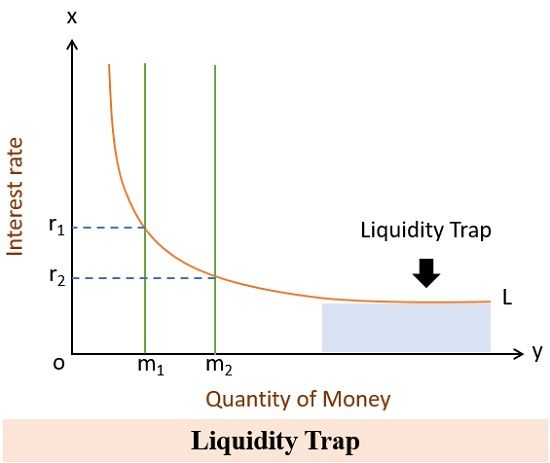

Definition of Liquidity Trap

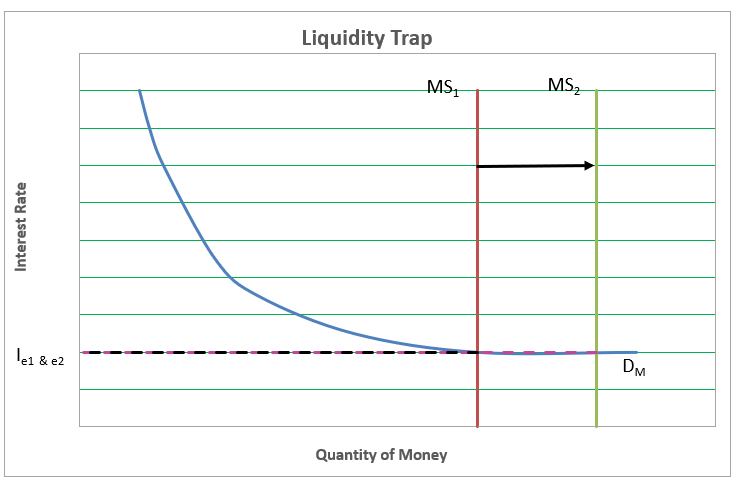

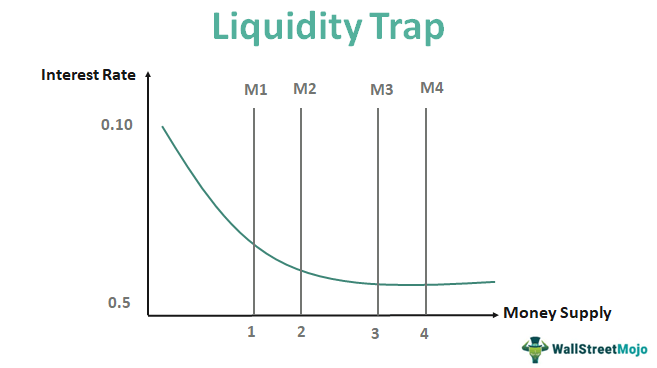

1. If the economy is currently in a liquidity trap, an increase in the money supply would shift the MS curve _ and interest rates would _. A. right; decrease B. right;

TheMoneyIllusion » The myth of Japanese policy ineffectiveness

Liquidity Trap - What Is It, Solutions, Causes, Examples

Liquidity Trap: Definition & Causes

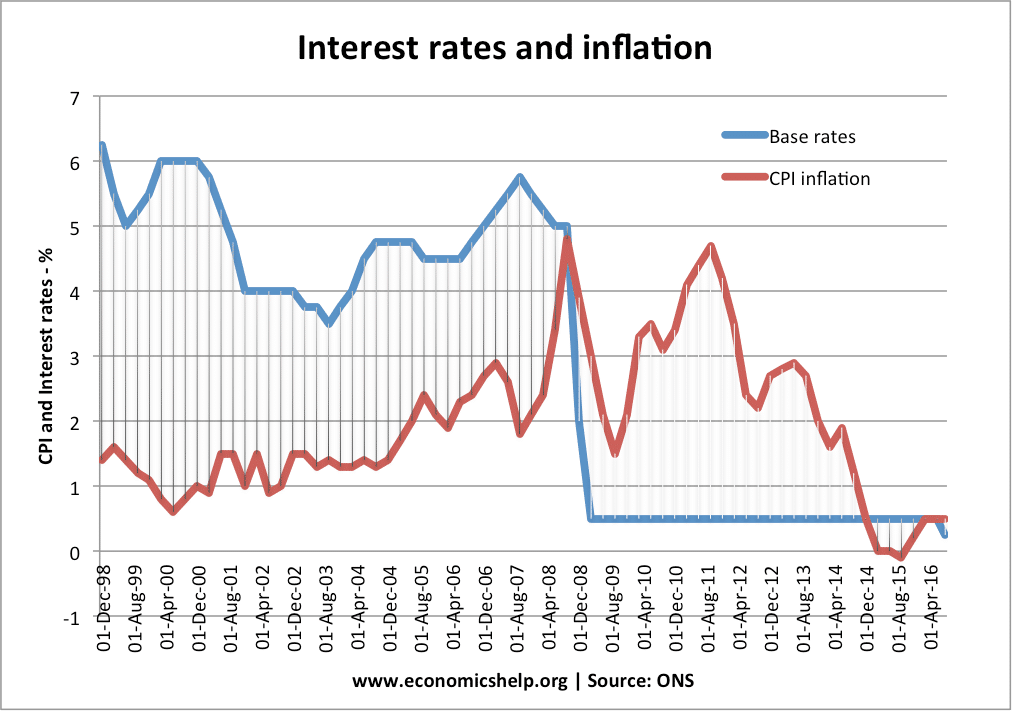

Liquidity Trap - definition, examples and explanation - Economics Help

Thinking about the liquidity trap

The liquidity trap: A. Refers to the vertical portion of the money demand curve. B. Refers to the possibility that interest rates may not respond to changes in the money supply. C.

Recomendado para você

-

Let the game begin! by Synergy14 on DeviantArt06 junho 2024

Let the game begin! by Synergy14 on DeviantArt06 junho 2024 -

Let the the game begin. Lettering Stock Vector06 junho 2024

Let the the game begin. Lettering Stock Vector06 junho 2024 -

Let Game Begin Hand Drawn Lettering Stok Vektör (Telifsiz) 144781668506 junho 2024

Let Game Begin Hand Drawn Lettering Stok Vektör (Telifsiz) 144781668506 junho 2024 -

Audizine Forums06 junho 2024

Audizine Forums06 junho 2024 -

Let the games begin - Let the games begin - quickmeme06 junho 2024

Let the games begin - Let the games begin - quickmeme06 junho 2024 -

Let The Game Begin06 junho 2024

-

Let The Game Begin (2010) filmi - -06 junho 2024

Let The Game Begin (2010) filmi - -06 junho 2024 -

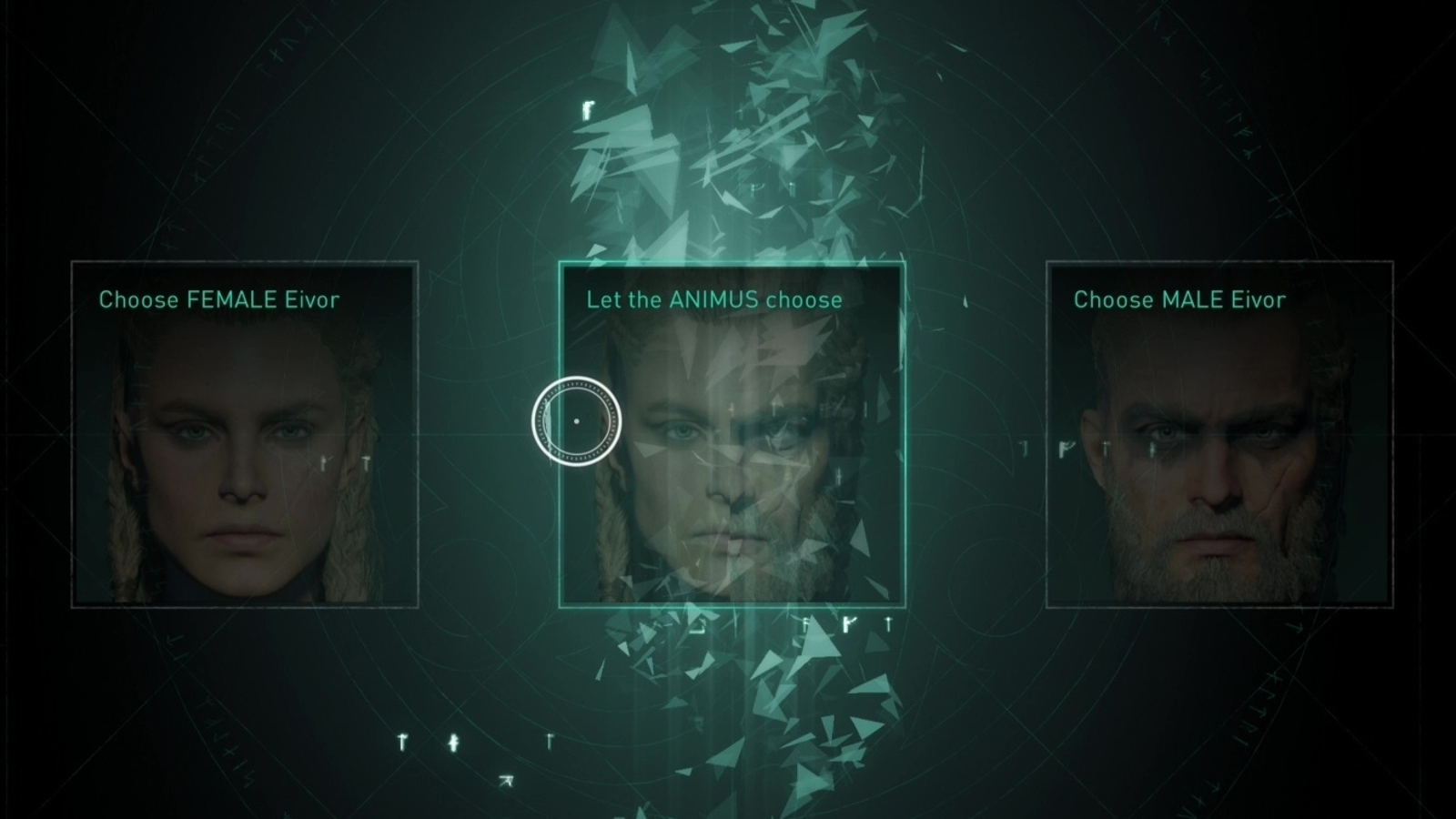

Assassin's Creed Valhalla - change gender: Let the Animus choose explained, and how to change between male and female Eivor appearances at any time06 junho 2024

Assassin's Creed Valhalla - change gender: Let the Animus choose explained, and how to change between male and female Eivor appearances at any time06 junho 2024 -

Demeo Battles Review: A New Iteration Of A Proven Success06 junho 2024

Demeo Battles Review: A New Iteration Of A Proven Success06 junho 2024 -

LET THE GAME BEGIN Poster, SAMY06 junho 2024

LET THE GAME BEGIN Poster, SAMY06 junho 2024

você pode gostar

-

kings night party flyer background gray silver with lights and stars (noche de reyes) Stock Vector06 junho 2024

kings night party flyer background gray silver with lights and stars (noche de reyes) Stock Vector06 junho 2024 -

muro-pedra-rachao- 2.jpg :: STRANIERI PEDRAS06 junho 2024

muro-pedra-rachao- 2.jpg :: STRANIERI PEDRAS06 junho 2024 -

Moto X3M 2 - Play Online on Snokido06 junho 2024

Moto X3M 2 - Play Online on Snokido06 junho 2024 -

FollowChess News – Page 34 – Pawn-sized chess news that matters!06 junho 2024

FollowChess News – Page 34 – Pawn-sized chess news that matters!06 junho 2024 -

Alice Keeler on X: How to Roll 3 Dice in Google - dice roller / X06 junho 2024

Alice Keeler on X: How to Roll 3 Dice in Google - dice roller / X06 junho 2024 -

E.o.s Polarized Enhanced Replacement Lenses For Oakley Juliet06 junho 2024

E.o.s Polarized Enhanced Replacement Lenses For Oakley Juliet06 junho 2024 -

Criciúma x Vila Nova Árbitro relata invasão do campo por dirigentes e xingamentos de técnico - Sagres Online06 junho 2024

Criciúma x Vila Nova Árbitro relata invasão do campo por dirigentes e xingamentos de técnico - Sagres Online06 junho 2024 -

Strongest Deliveryman (2017)06 junho 2024

Strongest Deliveryman (2017)06 junho 2024 -

Marketing Management 14e édition - Philip Kotler, Kevin Keller, Delphine Manceau - Livres06 junho 2024

Marketing Management 14e édition - Philip Kotler, Kevin Keller, Delphine Manceau - Livres06 junho 2024 -

Sword of the Stranger/Hindi Explanation/IMDB- 7.8/1006 junho 2024

Sword of the Stranger/Hindi Explanation/IMDB- 7.8/1006 junho 2024