Tax Underpayment Penalty: What It Is, Examples, and How to Avoid One

Por um escritor misterioso

Last updated 17 junho 2024

:max_bytes(150000):strip_icc()/Term-Definitions_Underpayment-penalty-Resized-7d6a14e797ad4b1584b7f659fff3a568.jpg)

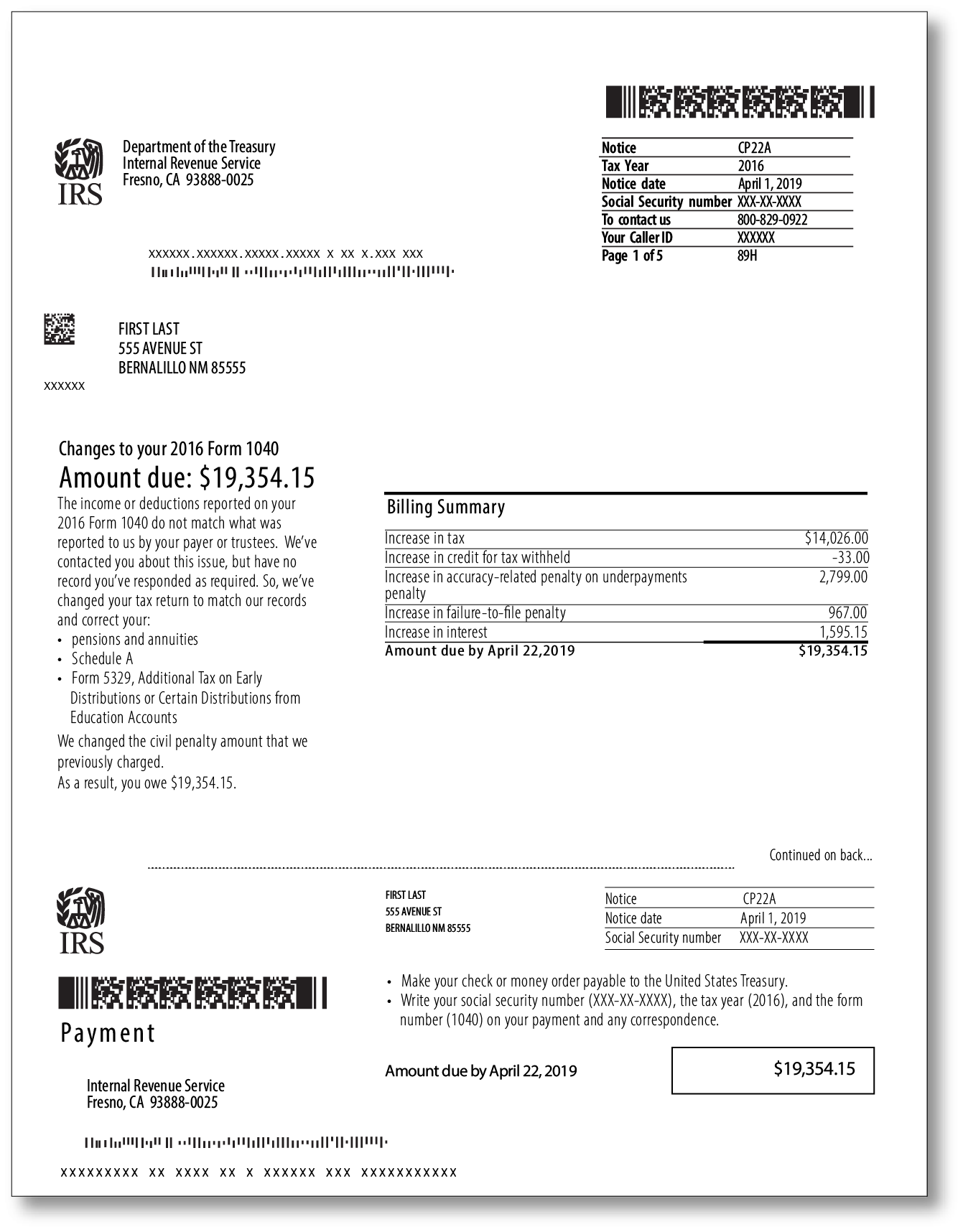

An underpayment penalty is an IRS fee for failing to pay enough of your total tax liability during the year. Here’s how to determine if you owe an underpayment penalty.

TaxAudit Blog, You got a CP22A

What You Need to Know About Underpayment of Tax Penalties

What Is The Penalty For Failure To File Taxes?

Avoiding Underpayment of Tax Penalty - TaxSlayer®

What is an IRS Accuracy Related Penalty?

Avoiding IRS Underpayment Penalties – Henssler Financial

Make Timely Tax Payments to Avoid Penalties - Shakespeare Wealth Management, LLC

What Is Estimated Tax? Calculations, Penalties, & More

Underpayment Penalty? Turbo Tax tells me I may owe?

Recomendado para você

-

Australia beat France in penalty shootout thriller to reach World Cup semis, Women's World Cup News17 junho 2024

Australia beat France in penalty shootout thriller to reach World Cup semis, Women's World Cup News17 junho 2024 -

Penalty shot - Wikipedia17 junho 2024

Penalty shot - Wikipedia17 junho 2024 -

Soccer Penalty Kicks: Rules and Strategies17 junho 2024

Soccer Penalty Kicks: Rules and Strategies17 junho 2024 -

Weekly Post 30017 junho 2024

Weekly Post 30017 junho 2024 -

Penalty Box in Soccer: Understanding the Penalty Box17 junho 2024

Penalty Box in Soccer: Understanding the Penalty Box17 junho 2024 -

Penalty Kick Wiz 🕹️ Play on CrazyGames17 junho 2024

-

Grey Wiggle no more: new penalty rules set to be introduced in July17 junho 2024

Grey Wiggle no more: new penalty rules set to be introduced in July17 junho 2024 -

Genius Penalty Kicks in Football History17 junho 2024

Genius Penalty Kicks in Football History17 junho 2024 -

What is a panenka penalty kick? Explaining name, style, famous17 junho 2024

What is a panenka penalty kick? Explaining name, style, famous17 junho 2024 -

Sam Kerr penalty kick, reaction video17 junho 2024

você pode gostar

-

:max_bytes(150000):strip_icc():focal(794x69:796x71)/wednesday-netflix-parents-112922-4-c05c3ac1a19e4cb6b2275073e327cb96.jpg) Wednesday Parents Guide: What to Know Before Watching with Kids17 junho 2024

Wednesday Parents Guide: What to Know Before Watching with Kids17 junho 2024 -

Sonic Ultimate RPG How to go inside darkspine obby17 junho 2024

Sonic Ultimate RPG How to go inside darkspine obby17 junho 2024 -

Veni Vidi Vici - Son dakika Galatasaray haberleri - Fotomaç17 junho 2024

Veni Vidi Vici - Son dakika Galatasaray haberleri - Fotomaç17 junho 2024 -

Soccer Stars Trick Shots - Microsoft Apps17 junho 2024

-

Emoji Ok png download - 512*512 - Free Transparent Emoji png Download. - CleanPNG / KissPNG17 junho 2024

Emoji Ok png download - 512*512 - Free Transparent Emoji png Download. - CleanPNG / KissPNG17 junho 2024 -

Parasite Eve Black Label PS1 Complete in Box CIB No Manual17 junho 2024

Parasite Eve Black Label PS1 Complete in Box CIB No Manual17 junho 2024 -

iTel S23 Plus: Hands-On Review17 junho 2024

iTel S23 Plus: Hands-On Review17 junho 2024 -

Dragon Ball Z: Sagas (2005)17 junho 2024

Dragon Ball Z: Sagas (2005)17 junho 2024 -

Dio bike Wallpapers Download17 junho 2024

Dio bike Wallpapers Download17 junho 2024 -

![The Legend of Zelda: Ocarina of Time [1] - Emulation on Android - Blogging Games](https://addictedgamewise.com/wp-content/uploads/2014/07/Meeting-Zelda.png) The Legend of Zelda: Ocarina of Time [1] - Emulation on Android - Blogging Games17 junho 2024

The Legend of Zelda: Ocarina of Time [1] - Emulation on Android - Blogging Games17 junho 2024