Tie Breaker Rule in Tax Treaties

Por um escritor misterioso

Last updated 17 junho 2024

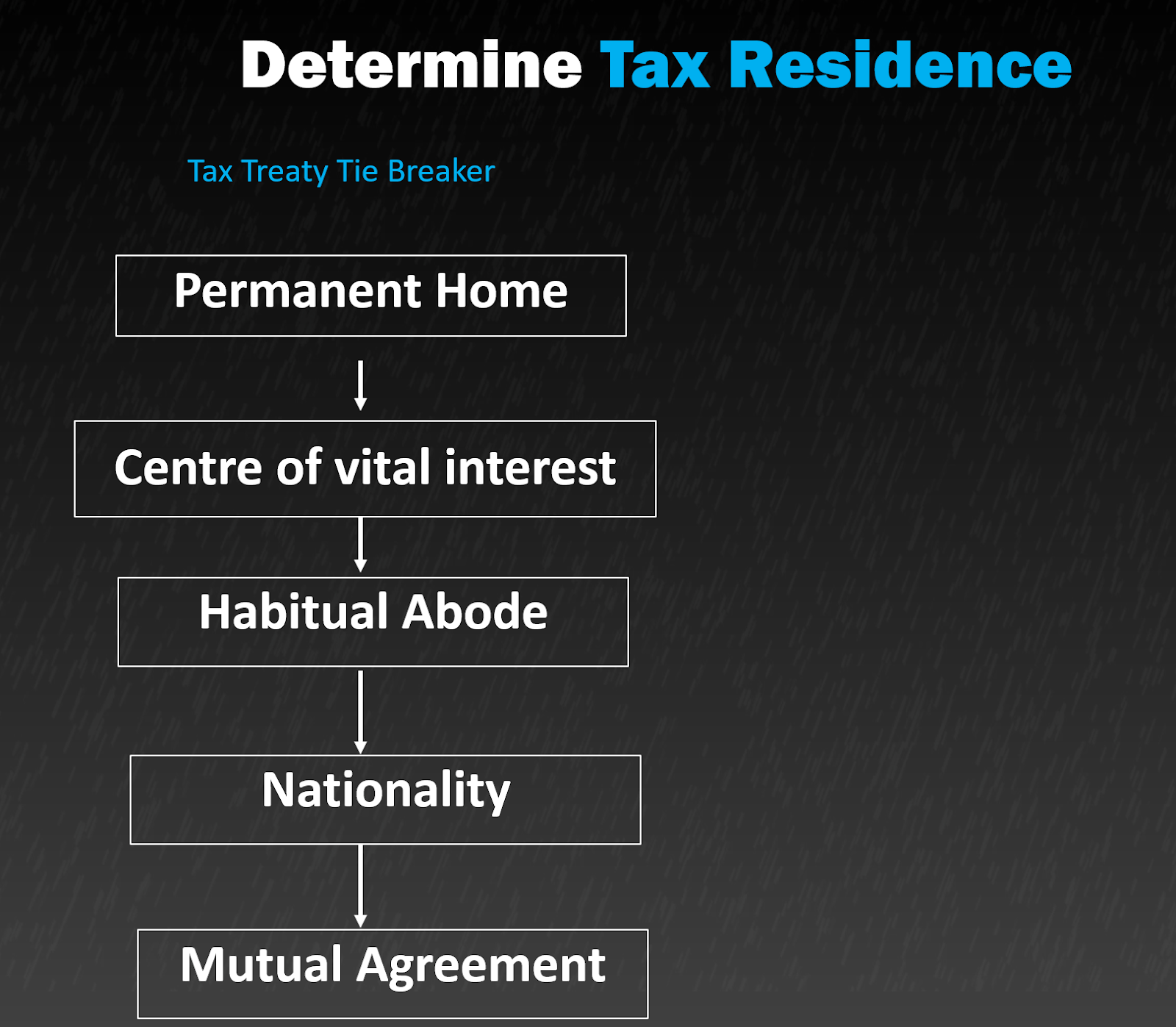

Hello Connections, Let’s briefly discuss the Tie Breaker Rule in Tax Treaties. Tie Breaker Rule are used when an individual becomes resident in both contracting states due to their domestic laws/rules, to determine the residential status of such individual for the purpose of taxability of income.

Residency Tie Breaker Rules & Relevance

PDF) The application of 'Tie-breaker rules' for the Tax Residence of Individuals

Tax Residency Status Modification: Mexican Tax Implication - Freeman Law

Canadian Snowbirds and U.S. Income Tax

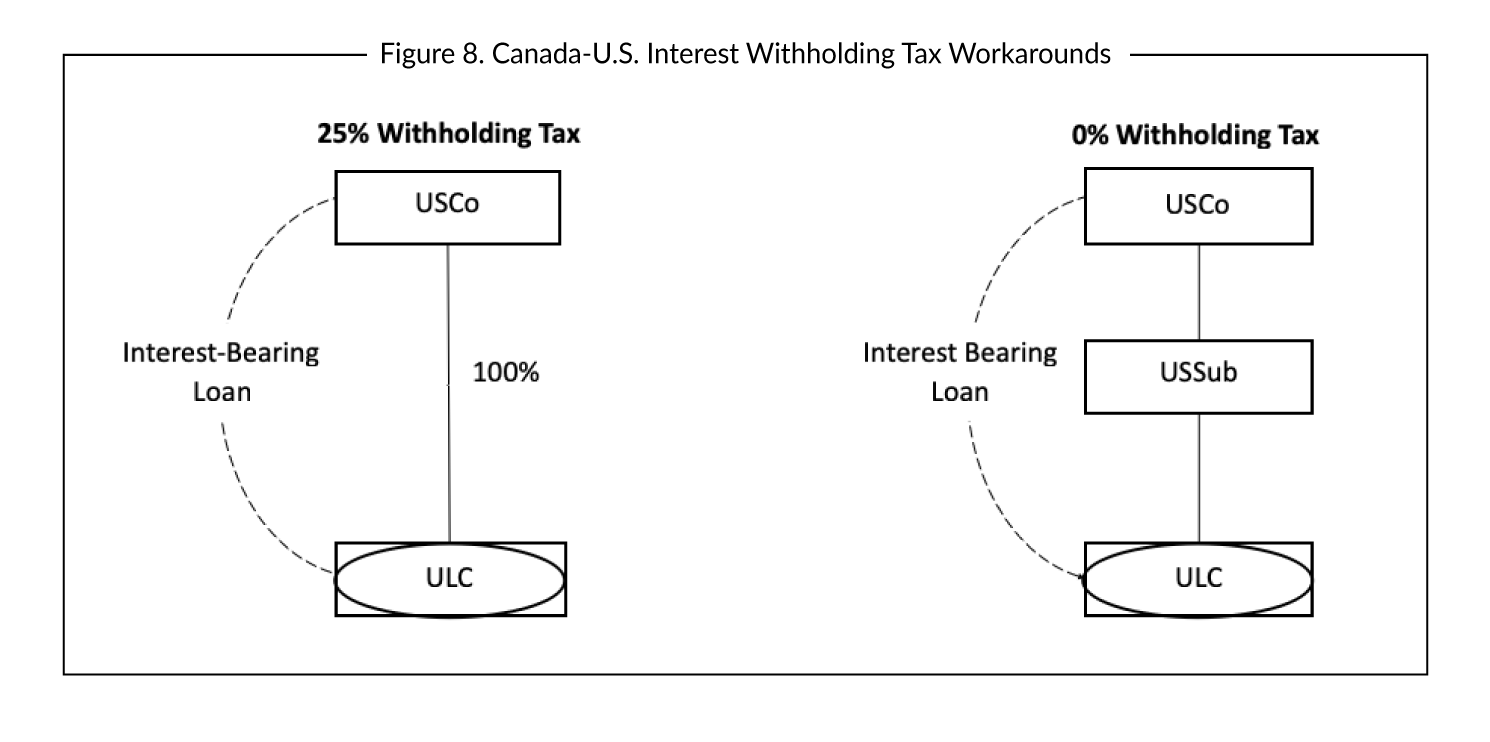

Tax Treaties Business Tax Canada

The Tax Times: LB&I Adds a Practice Unit Determining an Individual's Residency for Treaty Purposes

Navigating Tax Treaties: Insights from IRS Publication 519 - FasterCapital

How To Handle Dual Residents: The I.R.S. View On Treaty Tie-Breaker Rules - - United States

How To Handle Dual Residents: IRS Tiebreakers

TAX RESIDENCE. TIE-BREAKER RULES - Temple Cambria

Recomendado para você

-

Steel Dog Tie Breaker17 junho 2024

Steel Dog Tie Breaker17 junho 2024 -

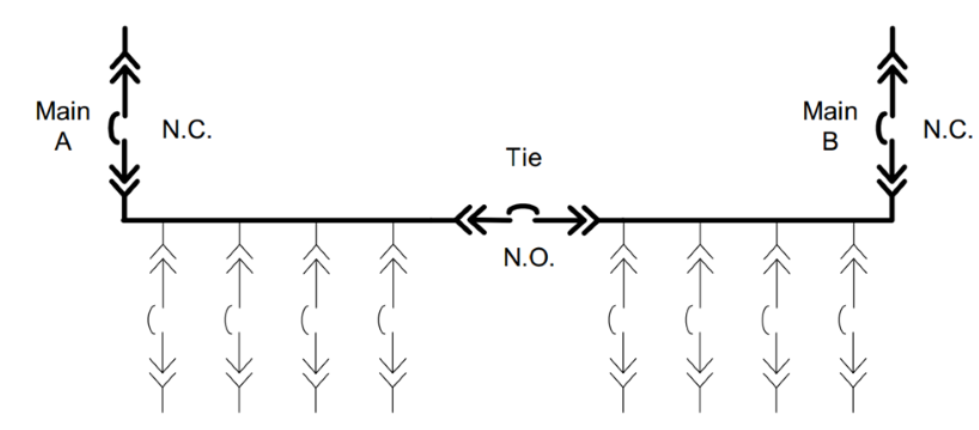

Tie-Breaker Configurations Download Scientific Diagram17 junho 2024

Tie-Breaker Configurations Download Scientific Diagram17 junho 2024 -

NEPSI - Redundant Power Systems: Main-Tie-Main17 junho 2024

NEPSI - Redundant Power Systems: Main-Tie-Main17 junho 2024 -

Tie-Breakers – QuizNightHQ17 junho 2024

Tie-Breakers – QuizNightHQ17 junho 2024 -

Tiebreaker Quiz Questions - Free Pub Quiz Trivia - Perfect For Any Event17 junho 2024

Tiebreaker Quiz Questions - Free Pub Quiz Trivia - Perfect For Any Event17 junho 2024 -

Proper Course: Tie-Breaker17 junho 2024

Proper Course: Tie-Breaker17 junho 2024 -

Tie breaker baby baby announcement Third baby announcements, New baby products, Baby announcement to husband17 junho 2024

Tie breaker baby baby announcement Third baby announcements, New baby products, Baby announcement to husband17 junho 2024 -

$300,000 price drop on 31m Hatteras motor yacht Tie Breaker17 junho 2024

$300,000 price drop on 31m Hatteras motor yacht Tie Breaker17 junho 2024 -

Tie Breaker, Bandipedia17 junho 2024

-

Stream Tie-Breaker - Friday Night Funkin' Corruption Takeover OST (LongestSoloEver) by Jeza17 junho 2024

Stream Tie-Breaker - Friday Night Funkin' Corruption Takeover OST (LongestSoloEver) by Jeza17 junho 2024

você pode gostar

-

Best of Palaeotumblr — T. rex Running by Gardow (Raptor Jesus)17 junho 2024

Best of Palaeotumblr — T. rex Running by Gardow (Raptor Jesus)17 junho 2024 -

Alfabeto Robô Transformers Dinossauro - Aprenda o ABC Brincando - Brinca Mundo Loja de Brinquedos17 junho 2024

Alfabeto Robô Transformers Dinossauro - Aprenda o ABC Brincando - Brinca Mundo Loja de Brinquedos17 junho 2024 -

Steven Tyler enjoys a family day out with strikingly similar daughters Liv, Mia and Chelsea and son Taj17 junho 2024

Steven Tyler enjoys a family day out with strikingly similar daughters Liv, Mia and Chelsea and son Taj17 junho 2024 -

Rini-tsukino GIFs - Get the best GIF on GIPHY17 junho 2024

Rini-tsukino GIFs - Get the best GIF on GIPHY17 junho 2024 -

Ito Ito No Mi One Piece Anime Hawaiian Shirt - Binteez17 junho 2024

Ito Ito No Mi One Piece Anime Hawaiian Shirt - Binteez17 junho 2024 -

Xadrez para Leigos - Eade, James - 9788576084327 com o Melhor17 junho 2024

Xadrez para Leigos - Eade, James - 9788576084327 com o Melhor17 junho 2024 -

Five Nights at Freddy's ending explained - Dexerto17 junho 2024

Five Nights at Freddy's ending explained - Dexerto17 junho 2024 -

Penguin Diner17 junho 2024

-

Luta Livre - USA17 junho 2024

-

Knock Out (Romanized) – 岡崎体育 (okazakitaiiku)17 junho 2024

Knock Out (Romanized) – 岡崎体育 (okazakitaiiku)17 junho 2024