FICA refund for F1 visa / OPT / CPT students – 1040NRA.com

Por um escritor misterioso

Last updated 31 maio 2024

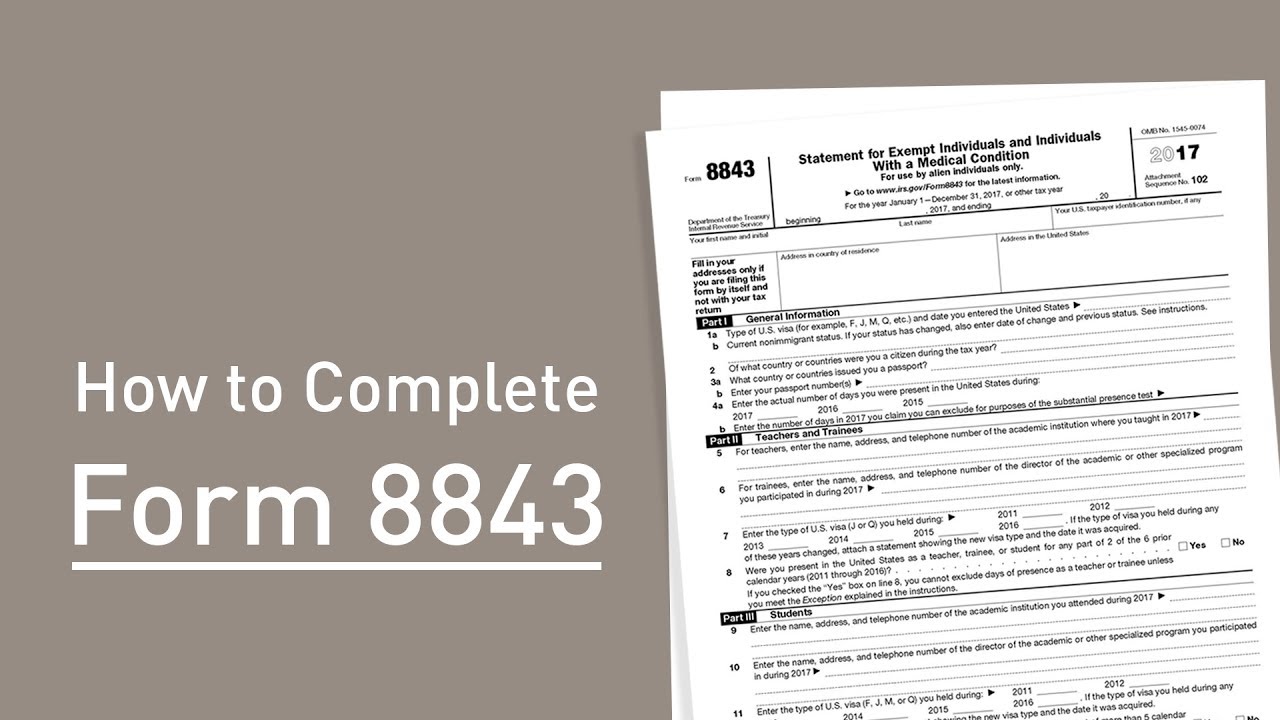

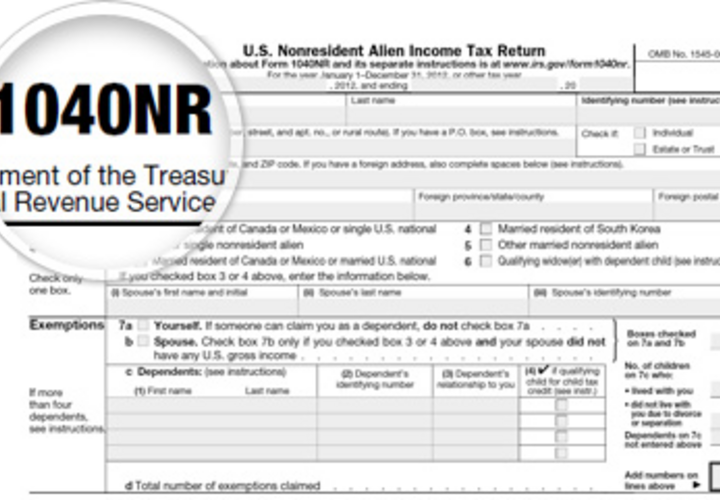

IRS Guideline: Social Security/Medicare and Self-Employment Tax Liability of Foreign Students, Scholars, Teachers, Researchers, and Trainees What is FICA? FICA is the abbreviation of the Federal Insurance Contribution Act. The FICA tax is a United States federal payroll tax administered to both employees and employers to fund Medicare and Social Security. This means that when you…

US Tax Return & Filing Guide for International F1 Students [2021

How does a student on an F1 OPT visa go about claiming a FICA

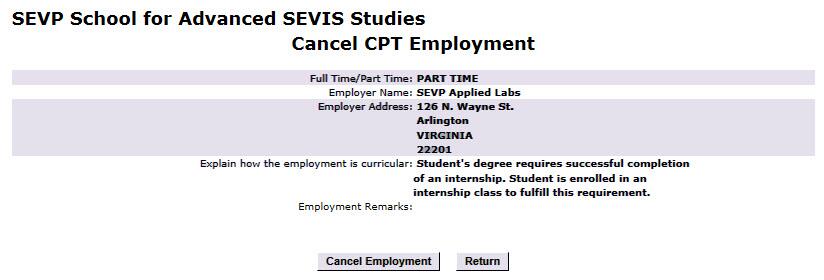

F-1 Curricular Practical Training (CPT)

Taxes - International Students and Scholars Office

How to Get FICA Tax Refund - F1 Visa, CPT and OPT Students

How to Get FICA Tax Refund - F1 Visa, CPT and OPT Students

U.S. Taxes Office of International Students & Scholars

Study in the US] U.S. international student tax filing -8

F1 student in the US and eligible for FICA tax refund? We have

Recomendado para você

-

What is Fica Tax?, What is Fica on My Paycheck31 maio 2024

What is Fica Tax?, What is Fica on My Paycheck31 maio 2024 -

What is FICA tax?31 maio 2024

What is FICA tax?31 maio 2024 -

What Is FICA, and How Much Is FICA Tax? Payroll taxes, Business tax, Financial life hacks31 maio 2024

What Is FICA, and How Much Is FICA Tax? Payroll taxes, Business tax, Financial life hacks31 maio 2024 -

FICA Tax: 4 Steps to Calculating FICA Tax in 202331 maio 2024

FICA Tax: 4 Steps to Calculating FICA Tax in 202331 maio 2024 -

Requesting FICA Tax Refunds For W2 Employees With Multiple Employers31 maio 2024

Requesting FICA Tax Refunds For W2 Employees With Multiple Employers31 maio 2024 -

What is the FICA Tax? - 2023 - Robinhood31 maio 2024

-

Do You Have To Pay Tax On Your Social Security Benefits?31 maio 2024

Do You Have To Pay Tax On Your Social Security Benefits?31 maio 2024 -

What Is FICA Tax?31 maio 2024

What Is FICA Tax?31 maio 2024 -

.jpg) What is FICA tax? Understanding FICA for small business31 maio 2024

What is FICA tax? Understanding FICA for small business31 maio 2024 -

Professional Beauty Association Push for Extension of FICA Tax Tip Credit to Self-Care Businesses – SalonEVO Magazine31 maio 2024

Professional Beauty Association Push for Extension of FICA Tax Tip Credit to Self-Care Businesses – SalonEVO Magazine31 maio 2024

você pode gostar

-

Copa do Mundo Feminina: como é composto o salário das jogadoras da31 maio 2024

Copa do Mundo Feminina: como é composto o salário das jogadoras da31 maio 2024 -

Rei Salomão. O Conhecimento e a Sabedoria31 maio 2024

Rei Salomão. O Conhecimento e a Sabedoria31 maio 2024 -

ACF Fiorentina English on X: Medical report: Dodo ACF Fiorentina31 maio 2024

ACF Fiorentina English on X: Medical report: Dodo ACF Fiorentina31 maio 2024 -

Chloë Grace Moretz and Brooklyn Beckham's Reunion Proves Young Love Is Complicated31 maio 2024

Chloë Grace Moretz and Brooklyn Beckham's Reunion Proves Young Love Is Complicated31 maio 2024 -

DEEP WEAB —fil.ota - Net-juu no Susume Recovery of an MMO Junkie Genres : Game, Comedy, Romance Rating : PG-13 - Teens 13 or older Episodes : 10 MAL Rating : 7.7231 maio 2024

-

Found this near the -X axis, at around 100k : r/2b2t31 maio 2024

Found this near the -X axis, at around 100k : r/2b2t31 maio 2024 -

Pepega High Quality Emote | Greeting Card31 maio 2024

Pepega High Quality Emote | Greeting Card31 maio 2024 -

Dragon Quest V - HotHB Dragon quest, Dragon warrior, Asian dragon tattoo31 maio 2024

Dragon Quest V - HotHB Dragon quest, Dragon warrior, Asian dragon tattoo31 maio 2024 -

DVIDS - News - Life and work of the Game Warden31 maio 2024

DVIDS - News - Life and work of the Game Warden31 maio 2024 -

2023 Minnesota Class 6A high school football brackets announced31 maio 2024

2023 Minnesota Class 6A high school football brackets announced31 maio 2024