Dysfunction in 'wildly illiquid' bond markets unnerves investors, officials

Por um escritor misterioso

Last updated 16 junho 2024

Extreme intraday price swings in government bonds, used as benchmarks for the pricing of a host of other assets, is another headache for officials navigating banking sector turmoil

Dysfunction in 'wildly illiquid' bond markets unnerves investors, officials

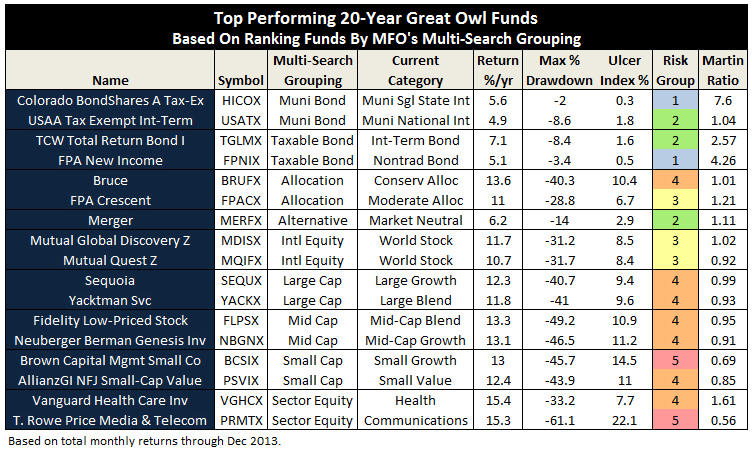

Search Results for SEEDX

Managing Liquidity Risk in the World's Deepest Bond Market — The New Capital Journal — New Capital Management

Mutual Fund Fragility, Dealer Liquidity Provision, and the Pricing of Municipal Bonds

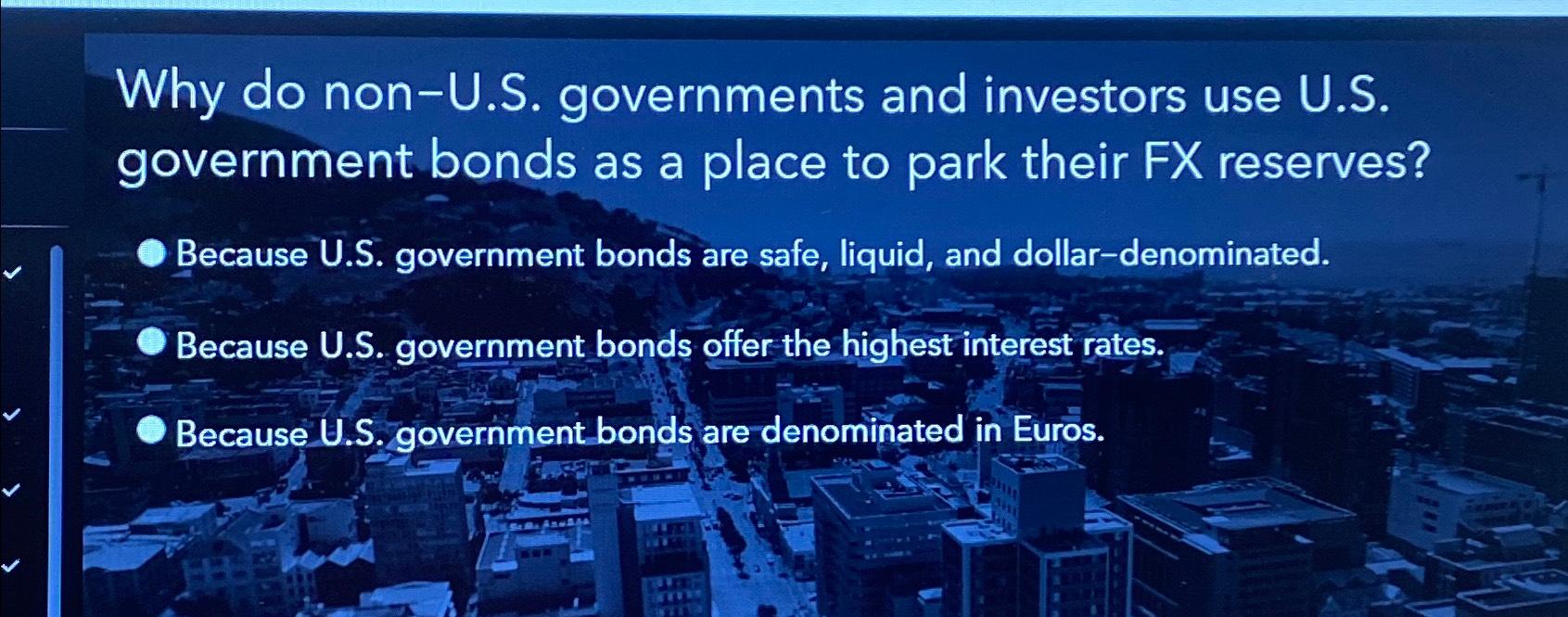

Solved Why do non-U.S. governments and investors use U.S.

Page 4783 of 24241 for Reuters

EXCA - Prime Fund

Search Results for SEEDX

Are there structural issues in U.S. bond markets?

/s3.amazonaws.com/arc-authors/reuters/bb562061-f849-4056-ad03-361656949839.png)

Dysfunction in 'wildly illiquid' bond markets unnerves investors, officials

D.C. Burglar Caught On Surveillance Camera

Recomendado para você

-

When Fear Unnerves Us, Everyday God Makes Us Brave - DiAnn Mills16 junho 2024

When Fear Unnerves Us, Everyday God Makes Us Brave - DiAnn Mills16 junho 2024 -

The Last House On Needless Street By Catriona Ward Unnerves16 junho 2024

The Last House On Needless Street By Catriona Ward Unnerves16 junho 2024 -

Philadelphia 76ers' arena plan angers Chinatown16 junho 2024

Philadelphia 76ers' arena plan angers Chinatown16 junho 2024 -

Morning Brief: Recession Fear Unnerves Stock Investors - AdvisorHub16 junho 2024

Morning Brief: Recession Fear Unnerves Stock Investors - AdvisorHub16 junho 2024 -

Fight by 2 Republicans for Georgia Senate seat unnerves GOP, WJHL16 junho 2024

Fight by 2 Republicans for Georgia Senate seat unnerves GOP, WJHL16 junho 2024 -

Rafael Shimunov on X: US support for ceasefire is so strong, that @JoeBiden has to hide massive weapons transfer to Israel from his own Democratic Party. #CeasefireNOW / X16 junho 2024

Rafael Shimunov on X: US support for ceasefire is so strong, that @JoeBiden has to hide massive weapons transfer to Israel from his own Democratic Party. #CeasefireNOW / X16 junho 2024 -

IMF's Stand on Greek Bailout Unnerves Europe - WSJ16 junho 2024

IMF's Stand on Greek Bailout Unnerves Europe - WSJ16 junho 2024 -

Proposed Conservative Dutch Climate Chief Unnerves EP Left ━ The European Conservative16 junho 2024

Proposed Conservative Dutch Climate Chief Unnerves EP Left ━ The European Conservative16 junho 2024 -

South African nuclear cache unnerves U.S.16 junho 2024

South African nuclear cache unnerves U.S.16 junho 2024 -

Anti-gentrification forces are winning in Chicago16 junho 2024

Anti-gentrification forces are winning in Chicago16 junho 2024

você pode gostar

-

Is it worth getting Gotham Knights?16 junho 2024

Is it worth getting Gotham Knights?16 junho 2024 -

Baller's Code & Price - RblxTrade16 junho 2024

-

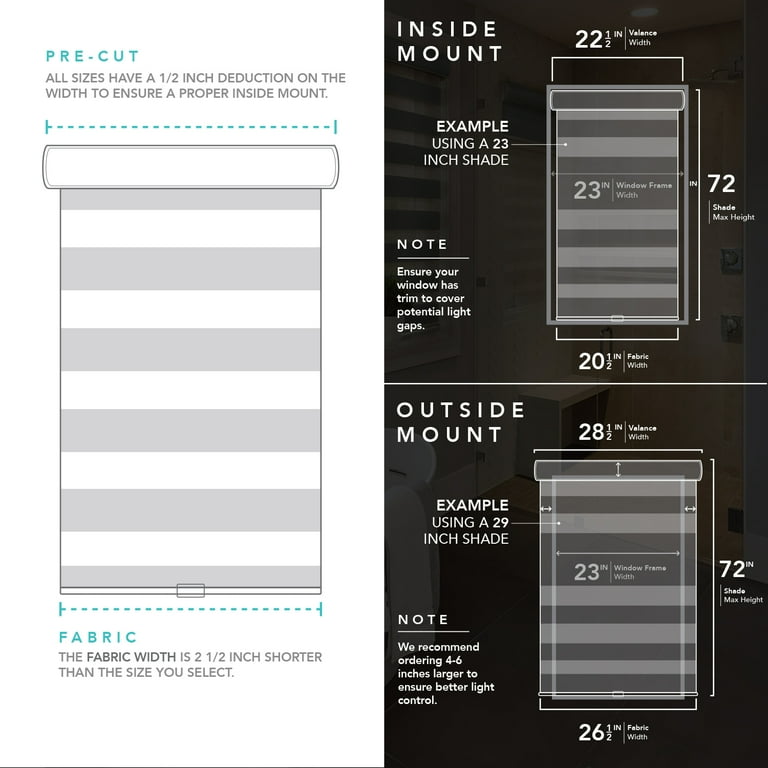

CHICOLOGY Dual Layer & Privacy Free-Stop Cordless Zebra Roller16 junho 2024

CHICOLOGY Dual Layer & Privacy Free-Stop Cordless Zebra Roller16 junho 2024 -

Review of Papers, Please16 junho 2024

Review of Papers, Please16 junho 2024 -

Kit Plantação Ecológico Minecraft16 junho 2024

Kit Plantação Ecológico Minecraft16 junho 2024 -

Horizon Zero Dawn 4K PC Gameplay - Absolutely Beautiful!16 junho 2024

Horizon Zero Dawn 4K PC Gameplay - Absolutely Beautiful!16 junho 2024 -

Foto de Objetos De Xadrez Peças E Dados Para Populares Jogos De Tabuleiro e mais fotos de stock de Aposta - iStock16 junho 2024

Foto de Objetos De Xadrez Peças E Dados Para Populares Jogos De Tabuleiro e mais fotos de stock de Aposta - iStock16 junho 2024 -

Skyzinhu16 junho 2024

Skyzinhu16 junho 2024 -

Hajduk Split Women x Znk Osijek » Placar ao vivo, Palpites, Estatísticas + Odds16 junho 2024

Hajduk Split Women x Znk Osijek » Placar ao vivo, Palpites, Estatísticas + Odds16 junho 2024 -

Trash Talker 216 junho 2024

Trash Talker 216 junho 2024